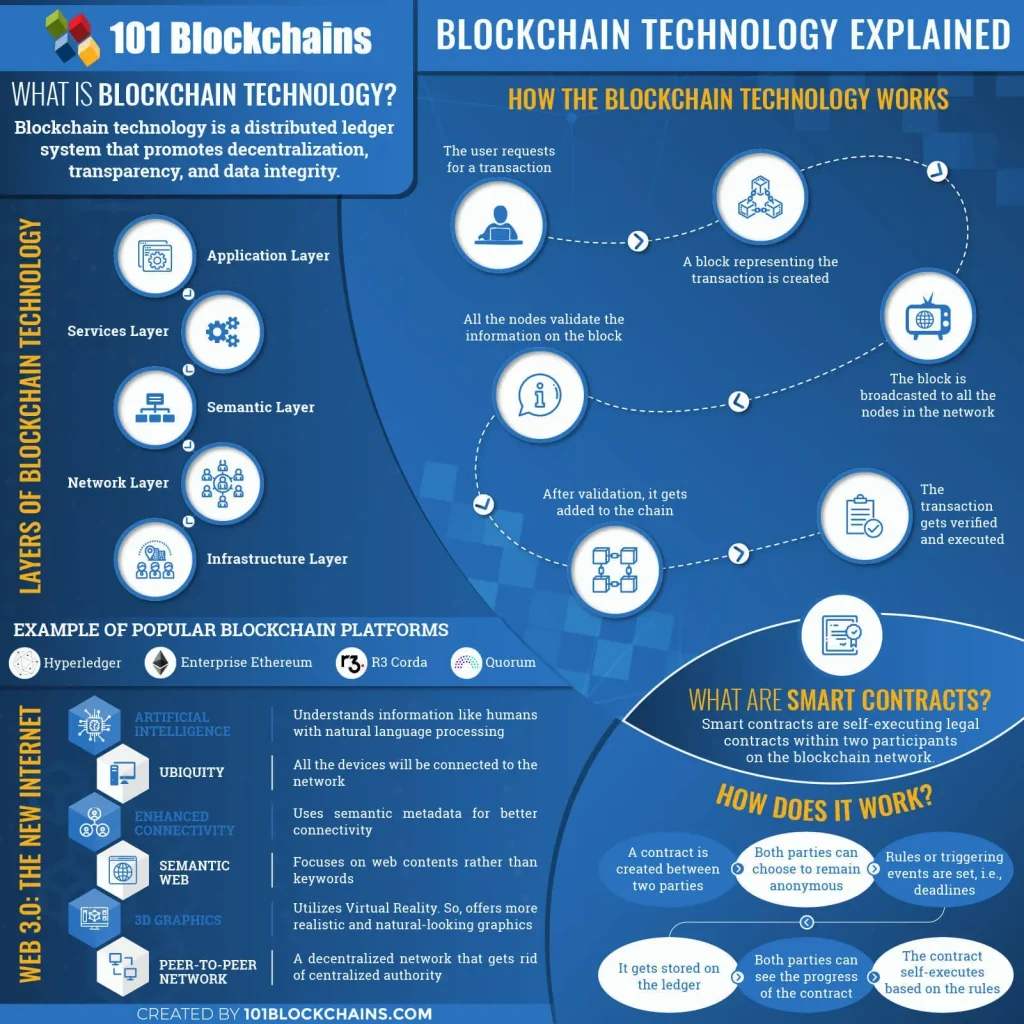

Blockchain technology explained is more than a buzzword. At its core, it describes a decentralized system where information is stored in a chain of blocks, secured by cryptography, and replicated across a network of computers. This architecture creates a ledger that is transparent, tamper-resistant, and accessible to participants with permission to join, enabling clear visibility into transactions. For organizations exploring the space, blockchain use cases across finance, logistics, and beyond are redefining how value is exchanged. The best entry points include smart contracts that automate agreements with minimal friction.

Viewed through a different lens, blockchain technology can be described as a distributed ledger system where records are held by numerous nodes and secured with cryptography. Instead of a single authority, consensus protocols coordinate agreement on the order of events, making historic entries tamper-evident across the network. In practice, these digital ledgers can be public or permissioned, enabling automated workflows, traceability, and resilient collaboration without a central gatekeeper. For business leaders, this shift translates into clearer data provenance, faster settlements, and audit-friendly governance across industries.

Blockchain technology explained: Real-world implications and distributed ledger technology benefits

Blockchain technology explained describes a decentralized system where information is stored in a chain of blocks, secured by cryptography, and replicated across a network of computers. This architecture creates a ledger that is transparent, tamper-resistant, and accessible to participants who have permission to join. By framing these fundamentals as practical capabilities, leaders can see how distributed ledger technology benefits translate into tangible business outcomes, from improved trust to streamlined operations.

These core attributes—decentralization, immutability, and consensus—drive real-world blockchain applications across industries. When aligned with blockchain use cases such as payments, supply chain transparency, identity management, and energy trading, the technology moves beyond theory into measurable results. Smart contracts further amplify value by codifying rules and automating workflows, enabling more efficient, auditable processes that reduce friction and reliance on intermediaries while maintaining governance and security.

Smart contracts and business automation: exploring blockchain use cases for blockchain for business

Smart contracts are self-executing agreements written into code and stored on the blockchain. They automatically enforce terms when predefined conditions are met, eliminating manual intervention and reducing disputes. In practice, smart contracts power a range of real-world blockchain applications—from trade finance and supplier payments to licensing and royalties—by enabling trusted, end-to-end automation without a central intermediary.

Adopting blockchain for business requires careful consideration of governance, privacy, scalability, and regulatory context. Organizations evaluate networks—public versus permissioned—and implement interoperability to connect disparate ledgers within an ecosystem. By focusing on data quality, measurable outcomes, and phased pilots, enterprises can accelerate blockchain use cases that enhance transparency, reduce costs, and unlock new revenue streams through distributed ledger technology benefits.

Frequently Asked Questions

What are blockchain use cases, and how does Blockchain technology explained relate to real-world blockchain applications?

Blockchain use cases describe practical applications of distributed ledger technology across industries. Blockchain technology explained helps you see how real-world blockchain applications—such as payments, supply chain traceability, identity management, and energy trading—use decentralization, immutability, and smart contracts to boost trust, transparency, and efficiency. Understanding this framework also clarifies how distributed ledger technology benefits—like reduced intermediaries and auditable records—shape governance choices between public and private networks to meet regulatory and performance needs.

How do smart contracts and distributed ledger technology benefits drive blockchain for business in real-world blockchain applications?

Smart contracts are self-executing code on the blockchain that automate the terms of agreements, reducing manual work and intermediaries. The distributed ledger technology benefits—tamper-evident records, traceability, and near real-time settlement—fuel real-world blockchain applications by enabling automated workflows in finance, supply chain, healthcare, and more. When planning blockchain for business initiatives, organizations should consider network choice, scalability, privacy, and governance to ensure alignment with goals and compliance.

| Topic | Key Points |

|---|---|

| What blockchain is | A distributed ledger that records transactions across many computers; blocks linked cryptographically; no single centralized authority; network consensus determines validity; tamper-evident ledger. |

| Core ideas | Decentralization; Immutability; Transparency vs privacy balance; Cryptography and security; Consensus mechanisms (PoW, PoS, and permissioned variants). |

| Real-world use cases | Payments and remittances; Supply chain transparency; Identity management; Healthcare data sharing; Energy and emissions trading; Governance and voting. |

| Smart contracts | Self-executing agreements coded on the blockchain; automate enforcement and workflows; reduce intermediaries; enable programmable business logic; oracles provide external data. |

| Adoption considerations | Benefits: enhanced traceability and auditability; reduced intermediaries and friction; improved data integrity; innovative business models. Challenges: scalability; energy efficiency; regulatory compliance; privacy; governance. |

| Interoperability and the road ahead | Interoperability across networks via standards and cross-chain protocols; interoperable architectures; importance in finance and supply chain; future driven by regulatory clarity and phased pilots. |

| Fundamentals: How it works | Blocks group transactions with timestamps and cryptographic links to previous blocks; distributed ledger means no central authority; consensus ensures valid transactions are added. |

Summary

Blockchain technology explained reveals a powerful paradigm for trustworthy, automated, and scalable collaboration. This descriptive overview shows how distributed ledgers, decentralization, and smart contracts translate into real-world value across finance, supply chains, identity, and energy. By examining fundamentals, use cases, advantages, challenges, and governance, organizations can plan implementations that improve transparency, efficiency, and trust while navigating privacy, scalability, and regulatory considerations. The ongoing move toward interoperability and phased adoption suggests a future where blockchain technology explained underpins more trusted and efficient business processes.