Global Finance Outlook frames how investors, policymakers, and traders interpret a landscape shaped by inflation, evolving growth patterns, and shifting policy signals. It highlights how Investments are allocated in uncertain times, emphasizing dynamic diversification, sector and regional rotation, and resilience across asset classes. Currencies respond to divergent paths in policy and growth, with volatility creating both hedging opportunities and selective carry potential for patient portfolios. As central banks recalibrate policy stances and public fiscal signals shape the backdrop, the pace of normalization can influence risk premia and capital costs. The aim is to translate these dynamics into a practical framework for positioning portfolios today, capturing interdependencies across markets and the opportunities policy signals create.

Beyond the headline frame, this discussion reframes the topic through a broader macro lens focused on growth trajectories, inflation dynamics, and policy architecture. Viewed through an investment lens, capital allocation considers asset class behavior, currency regimes, and the expected pace of rate normalization across regions. This framing aligns with related signals such as global market currents, regulatory developments, and the evolving balance between risk and return across geographies. Together, these ideas translate into practical steps for building resilient portfolios that withstand regime shifts and capture opportunities as policy and currency environments unfold.

Global Finance Outlook: Aligning Investments and Currencies with Shifting Monetary Policy

The Global Finance Outlook frames how Investments and Currencies behave as monetary policy evolves. With central banks pivoting toward data-driven normalization, policy moves shape risk premia, earnings trajectories, and exchange-rate dynamics. A well-constructed portfolio must reflect diversification across asset classes, regions, and factor styles to navigate inflation dispersion and growth gaps while remaining adaptable to evolving policy signals.

To position portfolios effectively, investors should blend growth-oriented equities with quality fixed income, while carefully managing duration and currency exposure. Incorporating real assets, commodities, and selective hedges can reduce drawdowns when policy surprises occur. By interpreting policy moves in major economies, you can identify relative-value opportunities across assets and geographies, align allocations with macro surprises, and maintain liquidity to seize dislocations as the global policy framework shifts.

Strategic Asset Allocation Amid Policy Moves and Currency Divergence

As policy moves diverge across central banks, asset allocation must be resilient to volatility in Currency markets and shifts in Monetary policy. A disciplined framework—emphasizing liquidity, broad diversification, and robust risk controls—helps capture opportunities while limiting downside risk when policy guidance surprises or when inflation dynamics evolve differently across regions.

Practical steps include scenario analysis for multiple policy paths, stress-testing for higher-for-longer inflation, and implementing currency overlays or hedging strategies that align with risk tolerance and return objectives. Tilt regional and sector exposure toward areas showing favorable policy momentum, maintain flexible risk budgets, and adjust allocations as guidance from major authorities updates to preserve resilience in portfolios amid ongoing Policy moves.

Frequently Asked Questions

What are the key implications of the Global Finance Outlook for Investments amid divergent monetary policy paths and policy moves?

The Global Finance Outlook supports a dynamic, diversified approach to Investments as monetary policy paths diverge and policy moves shift signals. It emphasizes blending global equities with selective growth and value exposures, managing duration and credit quality in fixed income, and incorporating real assets to hedge inflation. Practically, maintain balance across regions and sectors, use shorter-duration, high-quality bonds for ballast, and stay nimble to adjust as new policy signals emerge.

How do Currencies and Policy moves interact in the Global Finance Outlook, and what hedging strategies help manage currency risk?

Currencies respond to monetary policy and policy moves across major economies, making currency risk an integral part of portfolio construction under the Global Finance Outlook. Consider currency overlays, diversification with local-currency bonds, and selective hedging to limit downside while preserving upside participation. Monitor central-bank guidance and relative policy momentum to shape tilts toward or away from the USD and other key currencies.

| Topic | Key Points | Implications / How to Position |

|---|---|---|

| Global macro backdrop | Inflation has moderated from peak levels in many economies, but core pressures persist; growth is uneven; central banks are moving toward data‑driven normalization; policy remains the key driver of asset prices. Flexibility is essential as data arrives and policy cues change. | Adapt investment theses as new data arrives; adjust portfolios for evolving policy trajectories and currency dynamics. |

| Investments: portfolio implications in a volatile landscape | Diversification stays paramount but must be dynamic. Equities offer growth and inflation hedging over the long term; cyclicals may outperform during policy normalization, while defensives/quality bonds can provide ballast in sideways phases. Real assets and selective growth/value exposures can enhance diversification; duration management and inflation‑protected instruments are relevant in fixed income. | Build a blended global equity framework, manage duration, and consider real assets and hedged strategies to navigate policy cycles. |

| Currencies: navigating divergence and volatility | Diverging policy paths across major economies create volatility. The USD often serves as a global funding currency, but its strength can wane with faster growth elsewhere. EM currencies are sensitive to risk sentiment, commodity prices, and local policy. Currency hedges and overlays should align with anticipated policy paths. | Incorporate hedges, local‑currency exposure, and strategic overlays to balance downside risk and upside participation. |

| Policy moves and the policy mix | Policy is the broader terrain: not just rate decisions but fiscal impulses, regulatory changes, and reforms that alter the cost of capital. Fiscal stimulus plus accommodative policy can sustain growth, while tighter conditions can challenge risk assets, especially longer‑duration exposures. Monitor forward guidance and cross‑border policy signals for relative value opportunities. | Track policy signals across central banks and fiscal authorities; adjust asset allocation to exploit relative timing and regime shifts. |

| Asset allocation: translating the outlook into action | Discipline with a multi‑scenario framework: core bonds with quality and shorter duration; diversified equities across regions and factor styles (growth, value, quality); alternative assets (real assets, hedged strategies) for diversification; maintain liquidity and employ risk controls to avoid concentration during regime shifts. | Maintain liquidity for opportunities; tilt bonds toward quality/short duration; diversify across regions and factors; use alternatives to manage risk. |

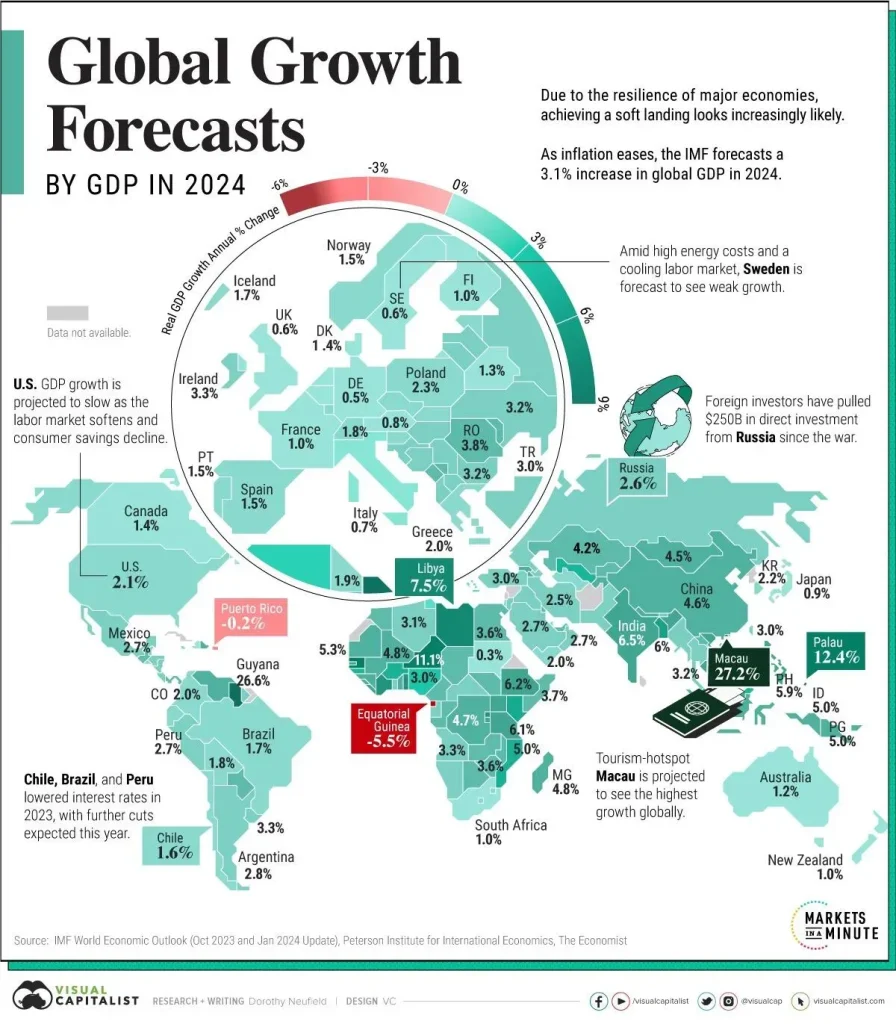

| Regional and sectoral outlooks | US: resilient consumer, solid labor market, Fed path remains central. Europe: energy, inflation persistence, and fiscal integration shape risk/reward. Asia: China policy stance and domestic demand matter. EMs offer potential as macro stability improves. Sectors like tech and healthcare may grow in supportive policy; financials can benefit from rate shifts. | Position regionally and by sector to reflect policy and growth differentials; diversify to capture cross‑regional opportunities. |

| Risks and scenario planning | Key scenarios include a soft landing with inflation under control, a policy misstep triggering volatility, and sharper growth slowdowns due to geopolitics or supply shocks. Currency volatility adds a layer of uncertainty. Stress testing, risk controls, and hedging are essential to navigate multiple outcomes. | Prepare for a range of outcomes with robust risk management and scenario testing. |

| Practical takeaways for investors and readers | Flexible, rules‑based asset allocation; higher‑quality fixed income with selective credit; currency considerations and hedges; broad diversification across regions and sectors; stay informed on policy signals to spot opportunities. | Implement a dynamic, diversified framework and stay attuned to policy developments. |

| Conclusion | A concise reminder of the Global Finance Outlook framework and its integration of macro trends, policy signals, and asset‑class behavior. | Global Finance Outlook emphasizes resilience and adaptability in portfolios amid evolving policy and currency regimes. |

Summary

Conclusion: The Global Finance Outlook emphasizes how investments, currencies, and policy moves interact to shape markets and portfolios, with a focus on resilience and adaptability to evolving macro conditions and policy signals.