Impulse buying is a common consumer behavior that can lead to financial strain, especially in our fast-paced digital age. With the convenience of online shopping, many of us find ourselves making spontaneous purchases we later regret, often driven by emotional triggers rather than necessity. Understanding how to manage impulse buying is crucial for improving consumer habits and maintaining a healthy budget. Here are some strategies to help you cultivate mindful spending practices that align with your financial goals. By following these online shopping tips, you can redirect your spending impulses towards more fulfilling purchases and avoid the pitfalls of unplanned transactions.

The phenomenon of spontaneous purchasing, commonly addressed as spontaneous shopping tendencies, often results in challenges for consumers striving to maintain financial balance. With the rise of e-commerce, many individuals experience a surge of excitement when engaging in retail therapy, leading to unmindful consumer decisions. It’s essential to recognize these behaviors and implement effective strategies to manage such impulses. Whether you’re interested in establishing a budget for shopping, assessing your consumer habits, or enhancing your overall spending mindfulness, there are actionable steps you can take to improve your experience as a shopper. Embracing these techniques fosters a healthier relationship with your finances, ultimately leading to smarter purchasing choices.

Understanding Impulse Buying in Online Shopping

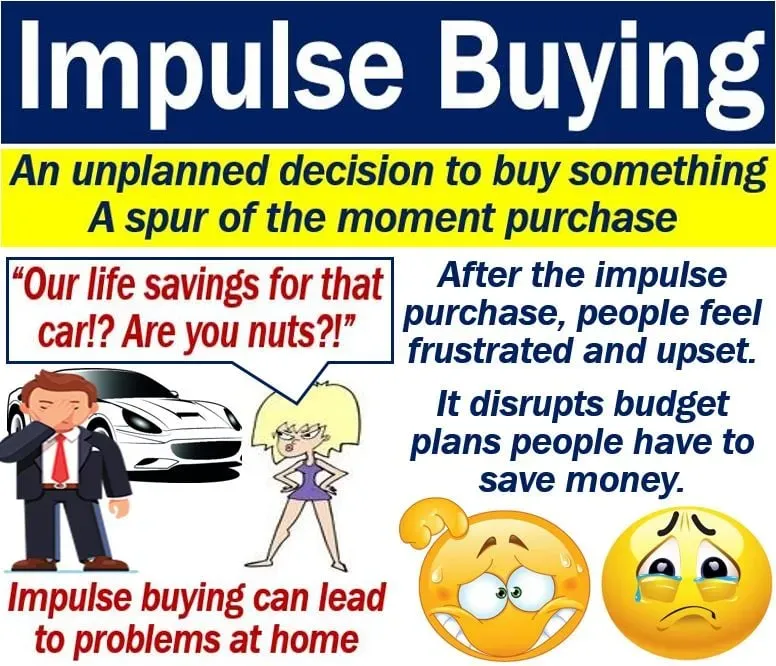

Impulse buying refers to the spontaneous and unplanned purchases that consumers make, often triggered by emotions rather than needs. In the realm of online shopping, this behavior is amplified by the ease of access and the instant gratification that comes with just a click. It’s important to understand that while impulse buying can sometimes lead to exciting new finds, it often results in regret and buyer’s remorse, especially when purchases do not align with one’s budget or genuine needs. Research shows that consumers are more susceptible to such behavior during sales events or when exposed to targeted marketing strategies that play on their emotions.

To manage this tendency, it is essential to identify what drives your impulse purchases. Is it boredom, stress, or the desire for instant gratification? Once you can pinpoint these triggers, you can develop strategies to combat them. For instance, you might consider waiting 24 hours before making a purchase decision or redirecting your attention to activities that fulfill you emotionally. This reflective practice not only curtails impulsive spending but also encourages mindful habits that help you articulate your genuine shopping desires.

Effective Strategies to Manage Impulse Buying

Managing impulse buying is crucial for maintaining fiscal responsibility in the age of online shopping. Start by setting clear limits on your shopping habits. Establish a budget that outlines how much you can afford to spend each month without affecting your essential expenses. Additionally, consider implementing a ‘cooling-off’ period for any purchases over a certain amount. This strategy provides you with the opportunity to reconsider whether the item is truly necessary or aligns with your long-term goals, minimizing the chances of impulsive buys.

Another effective approach is to create a shopping list before you browse online. Just like you might prepare a grocery list to avoid impulse food purchases, having a list for other needs can keep you focused on what you truly value and need at any given moment. This strategy not only streamlines your shopping experience but also helps to curb the temptation to explore unnecessary items, which often leads to spending beyond your initial intent.

The Impacts of Consumer Habits on Shopping Behavior

Consumer habits significantly influence how individuals approach shopping, especially in an era dominated by digital convenience. Many consumers ease into habits that promote excessive spending, particularly through online channels that cater to these ingrained behaviors. According to a study, habitual online shoppers are more likely to engage in problematic spending due to the accessibility of products and the alluring marketing campaigns that flood their feeds. These habits can lead to long-term financial distress if not addressed through conscious consumer behavior.

To counteract habitual overspending, analyze and adjust your shopping patterns. Ask yourself if you are purchasing due to necessity or out of habit. This self-awareness can help establish a healthier relationship with spending. Additionally, consider the emotional triggers that lead to excessive purchases, such as boredom or social pressure, which can shift your mindset toward budgeting and mindful spending.

Budgeting for Smart Shopping Decisions

Budgeting is a fundamental aspect of responsible shopping, serving as a practical tool to manage your finances effectively. A well-structured budget not only helps you allocate funds appropriately for necessary expenses but also establishes clear parameters for discretionary spending, including shopping. By allocating a specific amount for non-essential purchases each month, you can enjoy the benefits of shopping without the guilt of overspending.

Moreover, employing budgeting techniques such as the 50/30/20 rule—where you allocate 50% of your income to needs, 30% to wants, and 20% to savings—can guide your spending habits more efficiently. This method promotes a balance between enjoying the things you love while ensuring that you’re prepared for future financial goals. Tracking your budget regularly will also provide insights into your shopping behavior, helping you identify patterns that need adjusting.

Mindful Spending: Cultivating Awareness in Shopping

Mindful spending emphasizes the importance of being aware of your purchasing decisions and their consequences. This approach encourages consumers to reflect on what they genuinely need and the motivations behind their purchases. By promoting mindfulness, individuals can foster a healthier connection to their spending habits, which can lead to improved financial well-being and satisfaction in their purchases.

A simple technique to practice mindful spending is to ask yourself critical questions before making a purchase: Do I really need this? Will this item add value to my life? Does this align with my current goals? By taking a moment to evaluate your purchases, you can step back from impulse buying and align your expenditures with your values and needs, ultimately leading to a more fulfilling shopping experience.

The Role of Online Retailers in Impulse Purchases

Online retailers play a significant role in facilitating impulse purchases through strategic marketing techniques. They utilize algorithms and targeted advertising based on consumer behavior, luring customers into unplanned buying situations. Time-limited offers, flash sales, and personalized recommendations foster a sense of urgency that can trigger impulsive buying, often leading to purchases that consumers later regret.

To counteract these influences, consumers should remain vigilant about the marketing tactics used by retailers. By recognizing the strategies designed to provoke impulsive purchases, you can consciously decide to ignore them and focus instead on your financial goals. Taking the time to scrutinize advertisements and offers can empower you to resist the lure of shopping under pressure.

Curating Your Online Shopping Experience

In the digital age, curating your online shopping experience is crucial for managing impulse buying. By carefully selecting which newsletters to subscribe to and social media accounts to follow, you can eliminate distractions that encourage unnecessary spending. Focus on platforms that align with your values and shopping goals, avoiding those that promote mindless consumerism.

Additionally, consider employing website blockers or apps that limit access to frequently visited online shopping sites, especially during times when you know you’re more prone to impulse shopping. These steps can help cultivate a more intentional online environment encouraging mindful buying decisions and ultimately leading to better financial health.

Finding Joy in Secondhand Shopping

Shopping secondhand can be a fulfilling alternative to conventional retail, allowing you to discover unique treasures while also promoting sustainable consumer practices. Although these purchases may feel economical due to perceived savings, it’s essential to treat them with the same scrutiny as new items. The allure of discounted prices can still lead to impulse buys that don’t align with your true needs.

Moreover, cultivating the habit of evaluating secondhand purchases can empower you to spend wisely. Before buying, consider if the item fulfills a genuine need in your life or contributes to your goals. This reflective practice not only reduces impulse buys but also encourages appreciation for the sustainability aspects of secondhand shopping.

Investing in Quality over Quantity

The mantra of ‘quality over quantity’ is especially relevant in the context of responsible consumerism. Investing in well-made, durable items can save you money over time while reducing clutter in your home. While it may be tempting to buy numerous low-quality items at a discount, these purchases often lead to wastage and dissatisfaction in the long run.

By prioritizing quality purchases, you also support ethical brands that focus on sustainable practices. Researching and selecting items that align with these principles can lead to more rewarding shopping experiences. Ultimately, understanding the value of quality encourages you to buy less frequently, which helps curb impulse buying behaviors while promoting thoughtful consumption.

Conscious Choices for a Better Shopping Future

Making conscious choices in your shopping habits is imperative for fostering a healthier relationship with your finances. This involves not only recognizing the emotional triggers that lead to impulse buying but also prioritizing your needs over wants. Shifting your mindset towards intentional shopping can transform your experience from one of excess to one of joy and fulfillment.

Practicing conscious consumerism encourages you to think critically about the items you bring into your life and how they impact your overall well-being. By asking questions about necessity and origin, you can make more informed decisions that align with your values. This approach not only improves your financial situation but also promotes a sense of pride in your purchases.

Frequently Asked Questions

What strategies can help in managing impulse buying while online shopping?

To manage impulse buying during online shopping, consider setting time and budget limits. Break your shopping into designated days and establish a maximum spend per purchase. Additionally, try to bookmark items in a ‘maybe’ folder instead of buying immediately. This allows you to reassess your decision later and can reduce the impulse to click ‘Buy now.’ Making a shopping list can also enhance your focus on what you genuinely need.

How can mindful spending impact consumer habits related to impulse buying?

Mindful spending encourages consumers to think critically about their purchases, focusing on necessity and personal enjoyment rather than impulse. By evaluating each potential purchase through the lens of what you truly value, you can curb unnecessary spending habits. This approach can lead to improved financial health and a more satisfying shopping experience.

What role does budgeting play in preventing impulse buying?

Budgeting is crucial in preventing impulse buying as it clearly defines how much money can be allocated for shopping. By creating a budget, you set realistic spending limits which help you resist the temptation to purchase items that do not align with your financial goals. Sticking to a budget encourages disciplined decision-making, leading to more thoughtful purchases.

How can online shopping tips help reduce impulse buying?

Online shopping tips can significantly reduce impulse buying by guiding consumers to shop with intention. Tips like using shopping lists, setting timers, and decluttering your wardrobe can help you become more aware of your spending triggers. Following these strategies can promote more thoughtful purchases and help resist the allure of impulsive choices.

Why is it important to buy only for the real you to manage impulse buying?

Buying for the real you helps prevent impulse buying by ensuring that purchases align with your authentic self. When you choose items that reflect your style, body shape, and lifestyle rather than succumbing to trends or external pressures, you’ll find greater satisfaction in your purchases. This practice minimizes regret and reduces the likelihood of accumulating unnecessary items.

What are effective ways to rediscover what you already own to combat impulse buying?

To combat impulse buying, spend time organizing and reviewing your belongings. This not only highlights the items you’ve forgotten but also reminds you of what you truly value. Engage in activities like tidying up or even hosting a clothing swap with friends. By rediscovering your existing possessions, you can curb the urge to buy more and learn to appreciate what you already have.

How does secondhand shopping relate to impulse buying?

While secondhand shopping may seem like a budget-friendly choice, it can still lead to impulse buying if not approached mindfully. Just because an item is discounted doesn’t mean it fits into your needs or budget. It’s important to treat secondhand purchases with the same level of scrutiny as new items to avoid unnecessary spending.

What impact does curating your newsletters have on managing impulse buying?

Curating your newsletters is an effective strategy to manage impulse buying. By unsubscribing from retailer emails that entice you with constant promotions, you reduce exposure to temptations. Limiting these marketing influences helps you maintain control over your shopping habits and avoid impulsive purchases driven by special offers.

How can one practice mindful spending to create better consumer habits?

Practicing mindful spending involves regularly reassessing personal values and needs before making purchases. Create a conscious spending plan that focuses on long-term satisfaction rather than immediate gratification. This practice can enhance decision-making skills, leading to more fulfilling purchases and a healthier relationship with money.

What are the benefits of buying quality over quantity to avoid impulse buying?

Choosing quality over quantity helps reduce impulse buying by emphasizing long-lasting items that bring real value. Investing in fewer, higher-quality items can lead to a more sustainable wardrobe and satisfaction from purchases. This mindset discourages the fleeting thrill of fast fashion and promotes a more thoughtful approach to consumer habits.

| Key Point | Summary |

|---|---|

| Control your impulse clicks | Managing online temptations by saving items for later can reduce unnecessary purchases. |

| Set time and budget limits | Establish designated shopping times and budgets to limit impulse buys. |

| Curate your newsletters | Cancelling retailer newsletters can help avoid spending triggered by exclusive deals. |

| Buying secondhand is still buying | Even thrifting can lead to unnecessary spending; avoid it if you tend to impulse shop. |

| Buy quality, not quantity | Investing in fewer, high-quality items is preferable to buying many cheap ones. |

| Ditch fast fashion | Choosing sustainable, ethical clothing over fast fashion helps reduce waste and impulse buys. |

| Buy for the real you | Make purchases that align with your true self rather than aspirations or trends. |

| Rediscover what you’ve already got | Evaluating your existing items can curb unnecessary new purchases. |

Summary

Impulse buying can greatly affect your financial health and overall well-being. By recognizing the triggers of impulsive purchases and applying practical strategies such as setting limits and focusing on quality over quantity, you can regain control of your spending habits. Emphasizing thoughtful purchasing decisions allows you to spend wisely, ensuring that your acquisitions bring genuine satisfaction rather than fleeting excitement.